Last Update: 02/24/16

All experienced Florida foreclosure defense lawyers know that the national Foreclosure Mortgage Settlement Agreement contains a provision that mandates that lenders not go forward with a foreclosure if there is an alternative in the works for that home loan (for example, a loan modification or short sale is being negotiated).

You may recall, that the five Big Banks made a deal with all the state attorneys’ general: in sum, the banks would pay lots of money in a settlement deal, and in return, the states wouldn’t pursue criminal cases against them (for things like fraud). (For details, including a link to the deal documents, see our earlier post, “State Attorney Generals Settlement With Banks – How are the Homeowners Helped Here? They’re NOT.”)

Thing is, the banks here in Florida don’t seem to be following this part of the deal.

On September 3, 2013, an interesting letter was sent by Florida Attorney General Pam Bondi to the Florida Supreme Court, where the Attorney General reminds the High Court of the Mortgage Settlement deal and asks that Florida courts (i.e., all of those Florida judges out there overseeing the 300,000+ pending foreclosure lawsuits across the Sunshine State) to remember that this provision still exits. (Banks are supposed to file a request to delay the foreclosure lawsuit if there’s an alternative to foreclosure in the pipeline, a request that these foreclosure trial judges should be seeing in their dockets.)

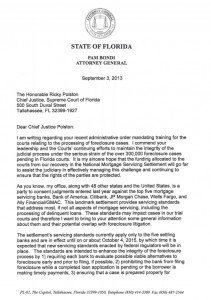

You can read Pam Bondi’s letter here by clicking on this image:

What the Florida Attorney General has written to the Justices of the Florida Supreme Court includes the following:

These standards may impact cases in our trial courts and therefore I want to bring to your attention some general information about them and their potential overlap with foreclosure litigation. ….

I urge you to become familiar with these standards so that, together, we may ensure that the banks are doing their utmost to comply with the settlement by providing alternatives to foreclosure where appropriate and avoiding improper dual tracking in contravention of the settlement.

National Mortgage Settlement Monitor’s Reports: Final Financial Report Released

Meanwhile, the final financial report from the National Mortgage Settlement Monitor has been released. (Read it here.) According to the Final Report, 120,000+ Florida borrowers have been paid over $9.22 Billion in settlement (that’s around $77,000 per borrower). Florida got more money in the deal for borrower payments than any other state in the country except for California.

That’s not all. The Report also has tallied $107 Million in direct money payments to approximately 73,000 Floridians that had their homes foreclosed upon by Florida banks.

Later this year, the National Mortgage Settlement Monitor will issue a report on how well the Big Banks who were part of this national mortgage settlement deal complied with the agreement.

Larry Tolchinsky’s Tip:

So, what’s happening in the Florida foreclosure courts right now? RealtyTrac has released a study that shows there are less new foreclosure lawsuits being filed in the past few months – with the new “foreclosure reform” law in place. According to RealtyTrac, in July 2013 the number of new foreclosure lawsuits being filed across the state fell 28% from July 2012. That’s a big change.

When asked what was going on here, the author of HB87, Florida Representative Kathleen Passidomo, opined that this is happening due to banks agreeing to more short sale offers.

Really?

Ask a Florida foreclosure defense lawyer what’s going on here, and you may get another answer. The new law makes the bank, as plaintiff in the foreclosure lawsuit, bring to court documentation that proves up the lender’s legal right (including title and ownership) to foreclose on that property. Florida law is stiff on land title law and Florida courts protect real estate title via compliance with strict title and ownership statutory requirements. More here.)

Florida foreclosure defense attorneys are aware of many issues in the ownership paperwork and some believe that banks aren’t filing as many new foreclosure lawsuits because they aren’t able to meet the new law’s demands regarding what they have to file.

And as for the popularity of short sales, ask a Florida relator. Or a prospective Florida home buyer.

Or just go read what some of these Florida real estate experts have written online, including an August 2013 article published by the National Association of Realtors’ trade magazine where a Florida realtor was explaining to her colleagues that short sales in Florida carry a “stigma” and where a recent Boca Raton study showed that homes specifically marketed as “not a short sale” were more popular with buyers.

A good piece of advice when you and your family are purchasing or selling your family home in one of the biggest transactions of your life is to at least talk with a Florida real estate lawyer. Getting someone to review all of the paperwork including the all important promissory note, isn’t as costly as most of us think it is. And it’s always a lot cheaper than paying to fix a problem after a closing occurs. Most real estate lawyers, like Larry Tolchinsky, offer a free initial consultation (over the phone or in person, whichever you prefer) to answer your questions.

If you found this information helpful, please share this article and bookmark it for your future reference.