First-time homebuyers are often anxious because the purchase of their single-family home or condominium will likely be the largest transaction of their lifetime. For this reason, a new home buyer may find this process less overwhelming when it is separated into 3 parts.

First, there is the contract for sale, which is where the buyer and seller agree to the essential terms of the transaction. This includes price, deposits, financing and the closing date. Second, is the due diligence period where the buyer inspects the property and obtains mortgage financing. The last part is the closing of the transaction where ownership is transferred and the money is exchanged.

Below are 6 helpful tips for first-time homebuyers as they go through each step in the home buying process.

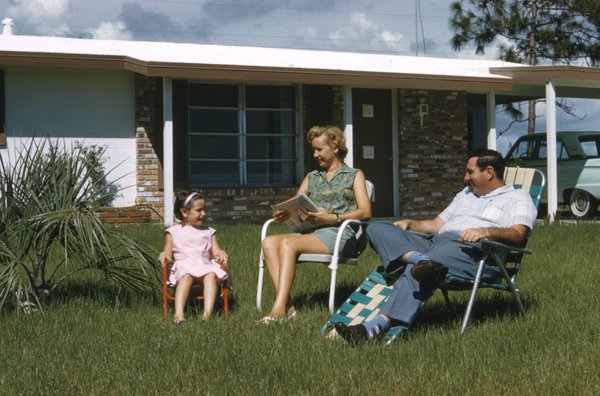

From Florida Memories, the American Dream of owning a family home here in sunny South Florida.

1. Financing the First Home Purchase

The first issue that most first-time homebuyers must overcome is gathering the money to buy the home. That means saving enough money for the down payment, inspections, appraisal, loan application fee, credit report, closing costs, as well as the monthly mortgage payment (which includes property taxes and insurance premiums).

Additionally, there are expenses related to moving, new furnishings, window treatments, repairs, as well as condo assessments or HOA fees.

Fortunately, there are avenues that help first-time homebuyers get the money needed to become homeowners. Some are federal programs, like FHA Loans. Others are local programs right here in South Florida:

County Programs for First Time Home Buyers in South Florida

All three counties in the tri-county area offer incentive programs to assist first-time homebuyers with the purchase of their first home. These include:

- Broward County: down payment assistance

- Miami-Dade County: subsidized mortgage loan program

- Palm Beach County: favorable mortgage rates.

2. Know the Documents: Did The Seller Sign A Tax Proration Agreement?

The home buying process involves a lot of documents. There’s the contract for sale between the buyer and the seller, which in addition to the items we discussed above, contains other important terms, like:

- who pays certain expenses,

- what happens in the event of default by one or both parties (dispute resolution procedures), and

- how title issues are resolved.

The contact also sets forth the documents the seller will have to provide to the buyer at the closing, including a bill of sale, affidavits as to liens and other issues that can affect title, a real estate taxes proration agreement, and, of course, the deed.

Additionally, there are mortgage documents, which include:

- the loan application,

- the promissory note (the document where the buyer promises to repay the loan with interest and late fees),

- the Loan Estimate and Closing Disclosure (they show the amount financed and the cost of loan), and

- the mortgage itself (the document that is security for the repayment of the promissory note).

Note: Real estate agents and brokers are not lawyers and are not authorized to practice law. They may tell you the documents you are signing are customary and no big deal, but if they offer you legal advice, you should be careful.

3. Know the Seller: Are You Buying From A Bank, Probate, Or Foreign Seller?

The seller is not always an individual person. The seller may be an Estate, where the owner of record has passed away. The seller may be a Trust where the Trustee will sign on behalf of the beneficial owners (the trust beneficiaries). Or, the seller may be a corporation, partnership, or the developer/builder who has just put up the new condominium.

A large number of sales in Florida consist of sellers that are not Florida residents. Or, they are a bank or condominium association that has taken ownership by way of foreclosure. This could mean the seller may live in another state or in another country.

In each of these scenarios, special requirements must be followed in order for the buyer to receive marketable title, like proper notarization of documents, corporate resolutions, trustee affidavits, and/or orders from the probate court authorizing the sale of the property.

See: How to Have a Deed Notarized if the Seller is in a Foreign Country

4. Know The Chain Of Title To The Property: Are There Liens And Easements?

When you buy a home, you buy more than the house. You buy the past history of the property, too. The buyer may be purchasing encumbrances of the title which include easements (rights of way) for the utility company and/or the association.

The goal of the buyer is to get “clear title” to the property, which is also known as marketable title. Marketable title is not perfect title, but it is title that is reasonably free from claims of other parties, including those in the chain of title.

This is why the closing agent, usually an attorney or title company, will perform a title search.

In a title search, the real estate records are carefully researched to see if there are any claims against the property or against anyone in the chain of title (i.e. a search is performed to see if there are judgments against any former or the current owner).

Liens can be filed by various taxing authorities as well as municipalities, houses, ex-spouses (child support), creditors, and contractors who have done work on the property but haven’t been paid.

If liens or other “clouds” are found on the title, then the home buyer should raise these title objections, in accordance with the contract, and demand these items be removed or satisfied before the closing takes place.

In situations where a title issue is found, a real estate lawyer is best suited to making sure that either the seller does what is necessary to clear up the title problem (like paying off a judgment creditor or other lienholder) or the transaction is terminated and the buyer receives a refund of the buyer’s earnest money deposits.

See:

- 3 Types of Title Issues Which Impact Florida Real Estate Closings

- How Do You Know If The Chain Of Title To Your Florida Real Estate Is Clear?

5. Know The Condition Of The Property: Inspections and Surveys

Sellers are required to disclose issues and conditions about the property that are not readily observable or discoverable by a buyer. If there is a flooding issue or an issue with mold or the plumbing, including septic tank issues, that needs to be explained to the buyer. Defects must be revealed by the seller under the law. Termite inspections should be conducted and the results provided to the buyer, as well. A buyer should make the transaction contingent upon the seller providing a “Seller Disclosure Statement” to the buyer and the buyer approving the disclosure statement.

Additionally, there needs to be confirmation about the exact boundaries for the property as well as the location of any special circumstances that affect the home being purchased. The boundaries will be provided as “metes and bounds” or as a “lot and block” in the legal description shown in the deed and other closing documents.

This is more than just the street address or MLS listing number. These official property boundaries are provided in a “survey” that is prepared by a professional surveyor licensed by the State of Florida.

All other property inspections, likewise, should be performed by licensed professionals. When hiring an inspector, look at the language in their agreement as to their liability if they missed a condition during their inspection. Some inspections limit their liability to the cost of the inspection.

If a first-time homebuyer decides to hire an attorney, the attorney should review the inspection report as well as the survey.

See:

- 10 Reasons to Have A Real Estate Inspection

- Duty to Disclose for Sellers in Florida Residential Real Estate Transactions

6. Know The Closing Process: Filing Documents In The Real Property Records

At closing, the seller delivers the keys, clickers, seller documents and the deed to the buyer. At the moment the deed is delivered to the buyer, the home buyer becomes the property owner.

As a buyer, be careful to read the provisions in the real estate contract about the closing procedures, including escrow closing procedures. A buyer should be careful about closing a transaction in “escrow.” Escrowed closings have their own set of issues that must be addressed before the transaction can close.

However, there’s still the matter of recording the deed. The seller delivers the deed to the buyer but the buyer doesn’t get to get the original deed right away. It needs to be recorded at the county courthouse, in the clerk’s office where the land records are kept. Deeds need to be properly recorded in order to make sure that the buyer is recognized as the owner of the home in the chain of title.

See: Florida Real Estate Closings Don’t End At The Closing Table

How Can A Florida Real Estate Lawyer Help?

There is nothing mandating that a home buyer have a lawyer’s counsel before going through with the purchase of his or her new home. However, this purchase may be the biggest financial transaction of the home buyer’s lifetime. It’s also one of the most complicated legal transactions most people will ever experience. Some closings can take hours to complete, with hundreds of pages of documents to review and sign.

Fortunately, hiring an experienced Florida real estate lawyer may be less expensive than most first-time home buyers may think. In fact, most real estate attorneys will work on a flat fee, and in a lot of instances having an attorney may end up saving the buyer a lot of money.

If you are buying your first home, a good piece of advice is to speak with an experienced Florida real estate lawyer to learn about your rights, including those related to inspections and title insurance. Most real estate lawyers, like Larry Tolchinsky, offer a free initial consultation (over the phone or in person, whichever you prefer) to answer your questions.

Related: 19 Reasons To Hire A Real Estate Lawyer When Buying A Home

If you found this information helpful, please share this article and bookmark it for your future reference.