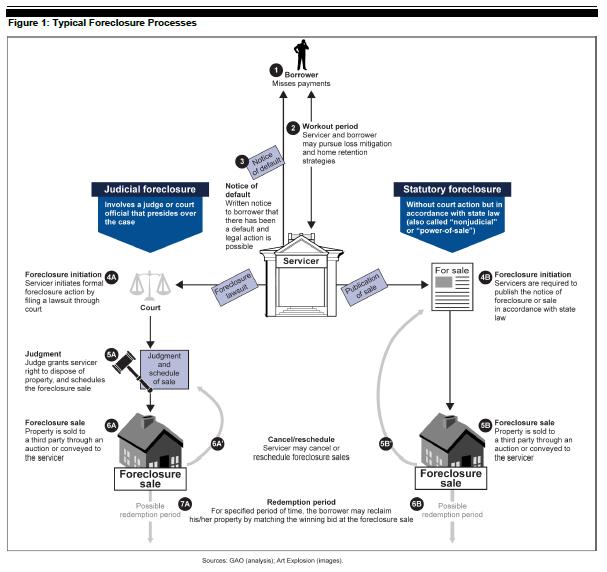

Florida is a “judicial foreclosure state.” Under our banking laws, when a bank seeks to exercise its right to obtain ownership of real property because of a breach of a mortgage, or a promissory note secured by a mortgage, it must file a lawsuit. This is true for any breach or default by the borrower of one of these agreements, including when the borrower fails to make a payment on the loan. (Many states follow the an alternative “non-judicial foreclosure process” – see image below.)

Why must a bank file a lawsuit? Under our laws, a bank must obtain a judgment signed by a judge in order to take possession and obtain legal title to the real estate. However, by filing a lawsuit, it gives the borrower the right to defend the foreclosure lawsuit, including challenging the right of the bank to foreclose.

For more on the overall Florida Foreclosure process, read “Florida Foreclosure Nuts and Bolts: What Happens in a Florida Home Foreclosure – The Florida Foreclosure Process in 10 Steps.”

Appealing a Trial Court’s Foreclosure Judgment

Foreclosure lawsuits begin at the trial court level. At their conclusion, if a final judgment is entered the clerk records the judgment in the court docket.

After a set amount of time passes (see rule 1.530 of the Florida rules of civil procedure), that judgment is considered “final” for all intents and purposes. A foreclosure sale occurs, and the certificate of title is filed, or recorded, in the public records where the property is located, evidencing transfer of legal title to the foreclosing party. At that time, the foreclosing party (i.e. the bank), assuming it is the high bidder at the foreclosure sale, can then sell the property to recover the amount due under the unpaid home loan.

If a borrower does not believe that the judgment was entered correctly or the judge made an error in the application of the law, then the borrower can file for a review of the judge’s determination with the appellate court. This is a court where several justices will review the issue and determine if there has been a legal mistake warranting a reversal of the trial court’s judgment.

You Need to Act Fast! There are Time Deadlines for Appealing a Foreclosure Judgment (Final Judgments and Summary Judgments).

There is a legal deadline for filing an appeal: a borrower has to do so within thirty (30) days of the final judgment being entered in the foreclosure lawsuit. After that time has passed, the judgment is final and not open for appellate review.

Also, from a practical stand point, you need to act fast because your lawyer, if you hire an appellate foreclosure lawyer, will need as much time as possible in order to review your case, including the transcript of the trial, to find a legal basis for the appeal.

That’s because there must be a valid legal error to appeal the judgment, which can can take time to determine. Some issues can require extensive research to formulate an argument for the preparation of an appellate brief (the document you file with the appellate court outlining the error or mistake).

Foreclosure Summary Judgment Appeals

When appealing a summary judgment, it is important to give the appellate lawyer as much time as possible because the appellate justices will review the foreclosure case “de novo.” Meaning, they will consider all of the evidence all over again.

In this situation, the borrower gets to present their case to the appellate judges, just like he or she did to the trial judge. Which means, that the borrower’s foreclosure lawyer will need enough time to find justifications or a factual basis for reversing that trial judge’s decision.

For more on summary judgments in foreclosures, see “Will Your Claim Survive a Motion for Summary Judgment?”

Foreclosure Appeal Arguments: How Can You Obtain a Reversal of a Foreclosure Judgment?

There are many legal arguments that can be made when appealing a foreclosure judgment. There is no cut and dry list to give you here.

This is due, in part, to all of the Florida foreclosure fraud that took place over the past decade, and the legislative directive given to the Florida courts to clear their bottleneck of foreclosure lawsuits on their court dockets. The issues ripe for appeal are bountiful.

For more on the Florida Fair Foreclosure Act, read:

- Florida House Bill 87 and Foreclosure Reform Passes Florida House and

- Florida Governor Signs Foreclosure Reform Bill HB 87 Into Law: Constitutional Violations of Due Process and Ex Post Facto Prohibitions Must Be Fought in Florida Courts.

With that said, the types of issues or mistakes that can be appealed can be unique to one case, or just a few cases. However, some errors are widespread, impacting many foreclosures filed by one lender or by one law firm.

Below, are just a few of the reasons we have seen for successfully overturning of a Florida foreclosure judgment. Please keep in mind as you review this list, your individual case should be reviewed by an experienced Florida foreclosure attorney to determine if it qualifies for an appeal.

1. Standing

One basis for reversing a foreclosure judgment is “legal standing.” Banks, as plaintiffs filing lawsuits, have to show the court that they have “standing,” or are the right parties to bring the lawsuit.

Who exactly has standing to foreclose? In a foreclosure lawsuit, is the only party that has a legal right to file the lawsuit to foreclose on your home the original holder of the note? Or, is a party that has all the legal rights of the original holder able to foreclose?

When you bought or refinanced your home, you signed both a mortgage and a promissory note.

The note is the legal document where you made the promise to make the mortgage loan payments. Is the holder of that note the only party that can legally sue when those payments have not been made?

See, “The Power of Real Estate Law: Banks Cannot Legally Foreclose Upon Real Estate Loans They Don’t Own.”

You can win a foreclosure appeal based upon standing if you can provide evidence to the appeals court that the bank / plaintiff failed to prove it had standing to file that foreclosure action. Who is a “holder”of the promissory note (see #5 below)? Is MERS a holder? Is a servicing company a holder? Can a trust be a holder?

In these Wild West Florida Foreclosure Fraud days, this is easier than it sounds. All too often, the plaintiff in the foreclosure action isn’t the original lender. That note might have been sold or assigned several times before the home owner stopped making mortgage payments.

For example, if the plaintiff bank cannot show that they had possession of the endorsed original note at the time that they filed their foreclosure lawsuit, then they did not have standing to sue.

We won a recent case on the issue of standing. See, “Florida Foreclosure Appeal on The Issue of Standing – Victory Against Bank of America.”

2. Lost Notes

You can fight a foreclosure in some cases if the bank files its lawsuit and alleges that it cannot provide the original note because it is lost. In this case, the bank files the foreclosure lawsuit without it. Later, the bank may amend its suit, filing what it claims to be an endorsed original. They give no reason for the delay in filing the note. No explanation of how it was lost or where it was found.

While a trial court may accept the late filed document, many Florida appeals courts do not.

The appeals court may find that if the bank didn’t have the original note when it filed the lawsuit for foreclosure, then it didn’t have standing to sue the borrower. See, Balch v. LaSalle Bank NA, 171 So. 3d 207 (Fla. Dist. Ct. App. 2015).

Inserting the note into the file later likely won’t work either. Lost notes don’t overcome the legal requirement that a foreclosure lawsuit must demonstrate legal standing to sue at the moment that the complaint is filed with the clerk’s office.

See, “Lost Notes in Florida Foreclosure Cases: Banks Must Prove Their Case With Valid Legal Documents.”

3. The Amount Of Damages

The bank must prove its case against the borrower just like any other lawsuit filed before the trial judge. The plaintiff has to prove that the defendant committed a legal wrong, like failing to make mortgage payments, and that as a result the plaintiff has been harmed.

In a foreclosure lawsuit, this means that the lender has to provide proper authenticated evidence of its damages. How it has been harmed, in dollars and cents. What’s due and unpaid?

For instance, the bank needs to file an Affidavit of Indebtedness. Affidavits are sworn documents. They must be signed with specific formalities or they are not valid and can not be relied upon as authenticated evidence.

If the lender did not prove up damages with proper authenticated evidence, then the borrower can argue on appeal that the foreclosure judgment is improper under the law and should be reversed.

4. Proper Business Record

The bank has a duty to provide the trial court with authentic and admissible evidence to prove its case. This is a legal duty that exists even if the borrower never answers the complaint and ignores the entire foreclosure trial process.

If there is not sufficient legal evidence, the the judgment should not be granted to the lender. This means that the bank needs to have proper business records placed before the court.

That’s easier said than done these days, given the Foreclosure Fraud fiascoes. All too often, the lender may not be able to find a person with true knowledge of the documents to prove they are authentic, for instance.

Authenticating business records cannot be waived just because it’s difficult for the bank to do.

The bank has to meet the rule of evidence here. All of its business records, including the promissory note and the default notice (or notice of acceleration – also, proof of compliance with paragraphs 15 & 22 of most mortgages), must be presented in proper and correct form.

Many times, banks cannot meet the hearsay exception to make their evidence admissible. They need to have a real, live witness who has personal knowledge of the borrower’s file to confirm the authenticity of its contents. If the lender cannot find this person, then what?

There have been lots of attempts by lenders to put other bank employees on the stand because they don’t have anyone with personal knowledge who can testify. These employees will try and maneuver around things as best they can.

However, if the borrower challenges this evidence on appeal, then a reversal is possible. The failure of the bank to prove up a proper business record can justify a reversal of the foreclosure judgment.

See, “Guide to Foreclosure Fraud Part 4: Examples of the Frauds Including the Story of the Now Infamous Linda Green” and “South Florida Foreclosure Defense Lawyers’ New Nemesis is The Robo-Witness: Bank Custodian of Records Without Personal Knowledge of the Loan Documents is Giving Hearsay Testimony.”

5. Non-Holder In Possession

Under Florida Statute 673.3011(2) ““a non-holder in possession of the instrument who has the rights of a holder,” may sometimes be entitled to enforce the note and foreclose in a foreclosure action.

However, that bank must be holding the note. If the complaint alleges that the lender was not in possession of the note, then they cannot legally foreclose. See, Seidler v. Wells Fargo Bank, N.A., 179 So. 3d 416, 420 (Fla. 1st DCA2015).

This is law derived from the Uniform Commercial Code, which has been adopted by the State of Florida. Legally, there are three different lenders who are involved with promissory notes with rights to enforce that note.

Under UCC Section 3-301, and Florida Statute 673.3011, the “persons entitled to enforce” are (i) the holder of the instrument, (ii) a non-holder in possession of the instrument who has the rights of a holder, or (iii) a person not in possession of the instrument who is entitled to enforce the instrument pursuant to Section 3-309 or 3-418(d).

In Florida, it’s rare to find foreclosures where the original lender is the one seeking to foreclose on the borrower. All too often, banks have sold those home loans to other lenders.

If these buyers of the mortgages seek to foreclose, then they can do so as a “person entitled to enforce” the promissory note if they can legally establish they are a “non-holder in possession who has the rights of a holder.”

This means providing the proper documentation and the proper business records, as discussed above. Failure to do so means that any foreclosure judgment is subject to reversal on appeal.

What Should You Do if You Want to File an Appeal?

If you want to appeal a foreclosure judgment (summary judgment or final judgment), time deadlines apply and you need to act fast. An experienced foreclosure lawyer should know how to file a request with the appeals court asking for a reversal of the trial court’s decision.

Go here to read the details on a recent foreclosure appeal victory we achieved for our clients against Bank of America.

An experienced appellate foreclosure lawyer may be able to suggest alternatives to you as well. For instance, you may be able to file a “motion to vacate the foreclosure judgment” with the trial court judge.

Motions to vacate can be based upon things like new evidence or mistake. However, that procedure may not make sense for every case. Not every homeowner can or should spend the time, money and effort to file a request to vacate a judgment.

If you believe you have grounds to file an appeal from a foreclosure judgment, a good piece of advice is to talk with an experienced Florida real estate lawyer. Most real estate lawyers, like Larry Tolchinsky, offer a free initial consultation (over the phone or in person, whichever you prefer) to answer your questions.

If you found this information helpful, please share this article and bookmark it for your future reference.

My parents home has been foreclosed. According to the filings, they consented. My mother has dementia and my father, a veteran and cancer patient is adamant he never consented to a foreclosure. The attorney has never verbally contacted my father. My father is also losing his memory and states he did not hire the lawyer. My parents are ill and do not want to leave the home. I have filed a motion to vacate the judgement on their behalf. What alternatives will I have when I appear in Court with my father?